can you pay california state taxes in installments

It may take up to 60 days to process your request. If you dont pay your California property taxes you could eventually lose your home through a tax sale.

California Franchise Tax Board Information Larson Tax Relief

What do you do if you owe state taxes and can t pay.

. The amount of your payments is based on how. Typically you will have up to 12 months to pay off your balance. Otherwise you could lose your home in a tax sale.

If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement. If you are unable to pay your state taxes you can apply for an installment. Usually you can have from three to five years to pay off your taxes with a state installment.

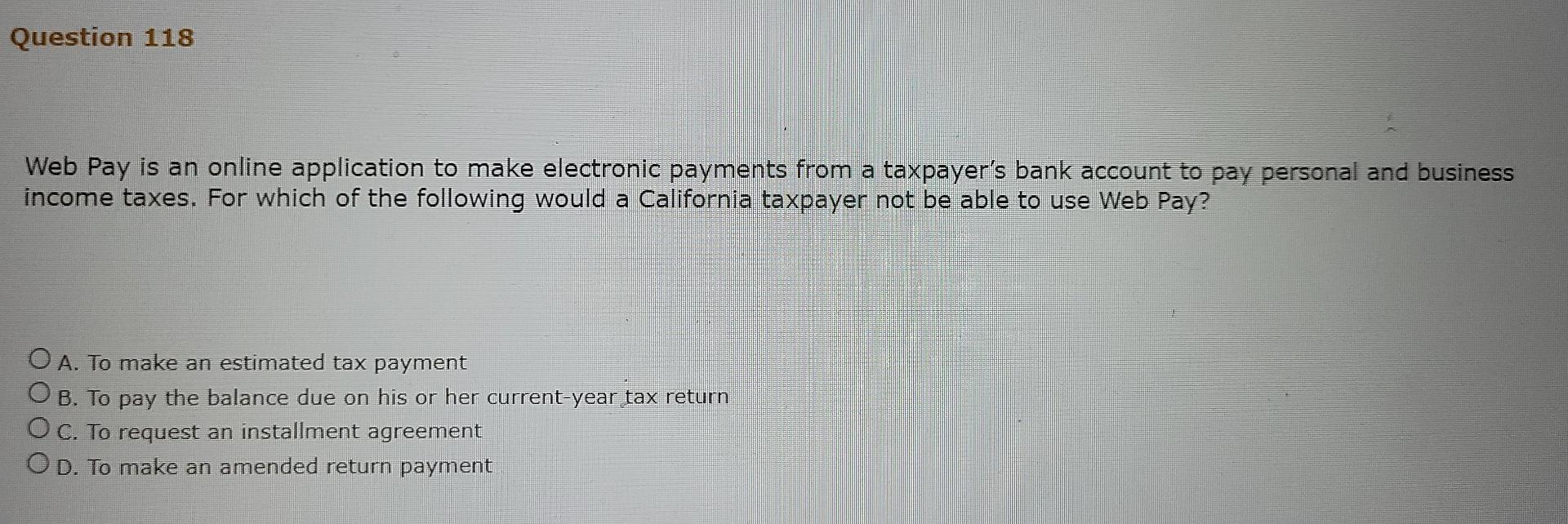

You can check your balance or view payment options through your online account. Pay a 34 set-up fee that. Can I set up a payment plan for state taxes.

You can also request a payment plan online. Pay a 34 set-up fee that the FTB adds to the balance due. Your remittance voucher is included in your instalment reminder package the CRA mails to you unless you pay instalments by pre-authorized debit.

At what age do you stop paying. You must meet certain basic admission requirements to be approved. Yes California offers taxpayers the option to set up a California tax payment plan.

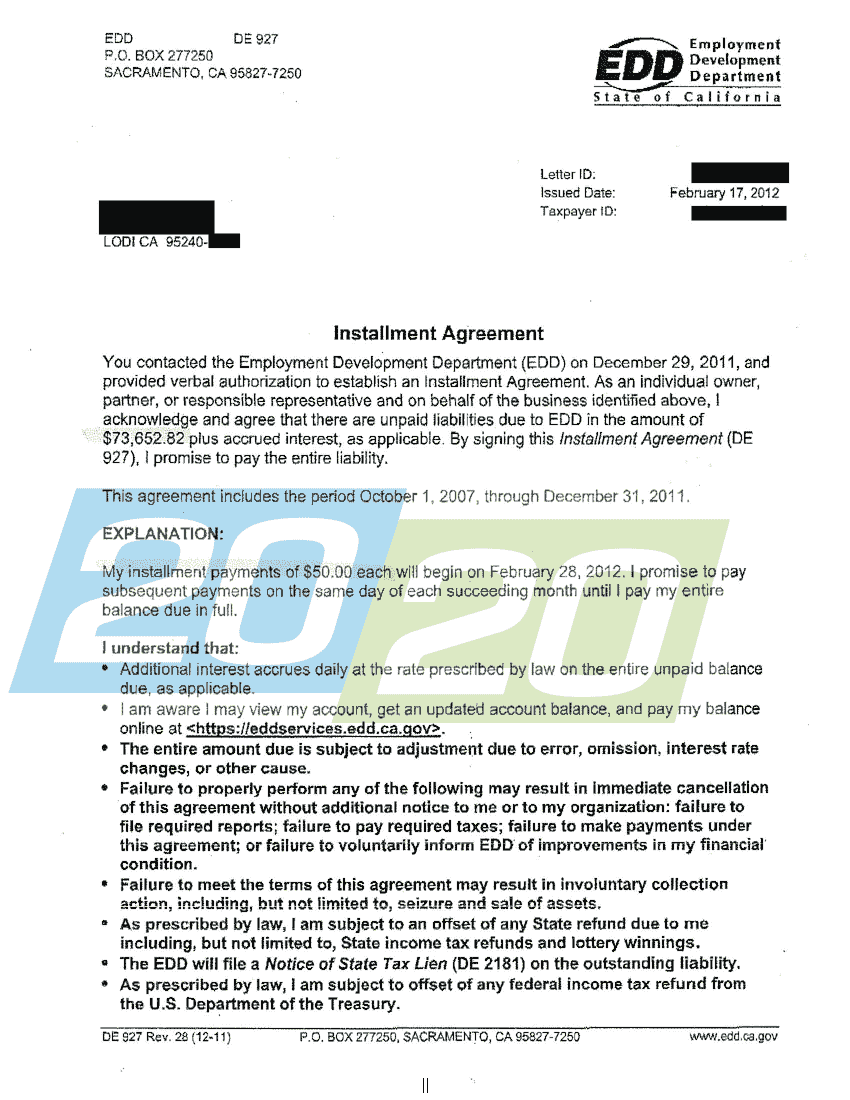

CA FTB Installment Agreement Conditions. The requested tax instalment payment is always equal to 14 of the tax owing at the end of the previous year. If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement.

If you dont pay SUI tax there are several penalties that can apply. You may have to pay tax instalments for next years taxes if your net tax owing is more than 3000 for Quebec 1800 for 2022 and in either 2021 or 2020. As an individual youll need to.

More In News Dont panic. If you cannot pay the full amount of taxes you owe you should still file your return by the deadline and pay as. 15 of the amount due with a.

Pay through Direct Debit automatic monthly payments from your checking account also known as a Direct Debit Installment Agreement DDIA. What happens if you dont pay SUI tax. Once this is done you.

You should apply for a payment plan if you believe you can pay your taxes in full within. A payment plan is an agreement with the IRS to pay the taxes you owe within an extended period of time. If you are unable to pay your state taxes you can apply for an installment agreement.

Yes you can pay your California property taxes online through the county tax collector s website. The state typically gives a taxpayer three to five years to pay off a balance once a California state income tax payment plan has been granted. I have installments set up for my federal taxes but I did not see an option.

Under a long-term payment plan you gradually pay off your tax bill in monthly installments over a maximum of 72 months. You will need to create an account and provide your propertys information. If you have not received your bill by November 1 please contact the Tax Collector at 805 781-5831.

Usually you can have from three to five years to pay off your taxes with a state installment agreement. The deadline to pay 2020 income tax is April 15. So for example if your last income tax bill came to 3600 the.

Please contact the Tax Collector by email at email protected or by phone at 805 781. An Installment Agreement allows you to pay your taxes over an extended period of time while avoiding collection actions from the IRS such as garnishments and levies. Failing to file a quarterly UC tax report.

Tax instalment payments are. The taxpayer must agree to the following Taxpayer Installment Agreement Conditions while in an Installment Agreement.

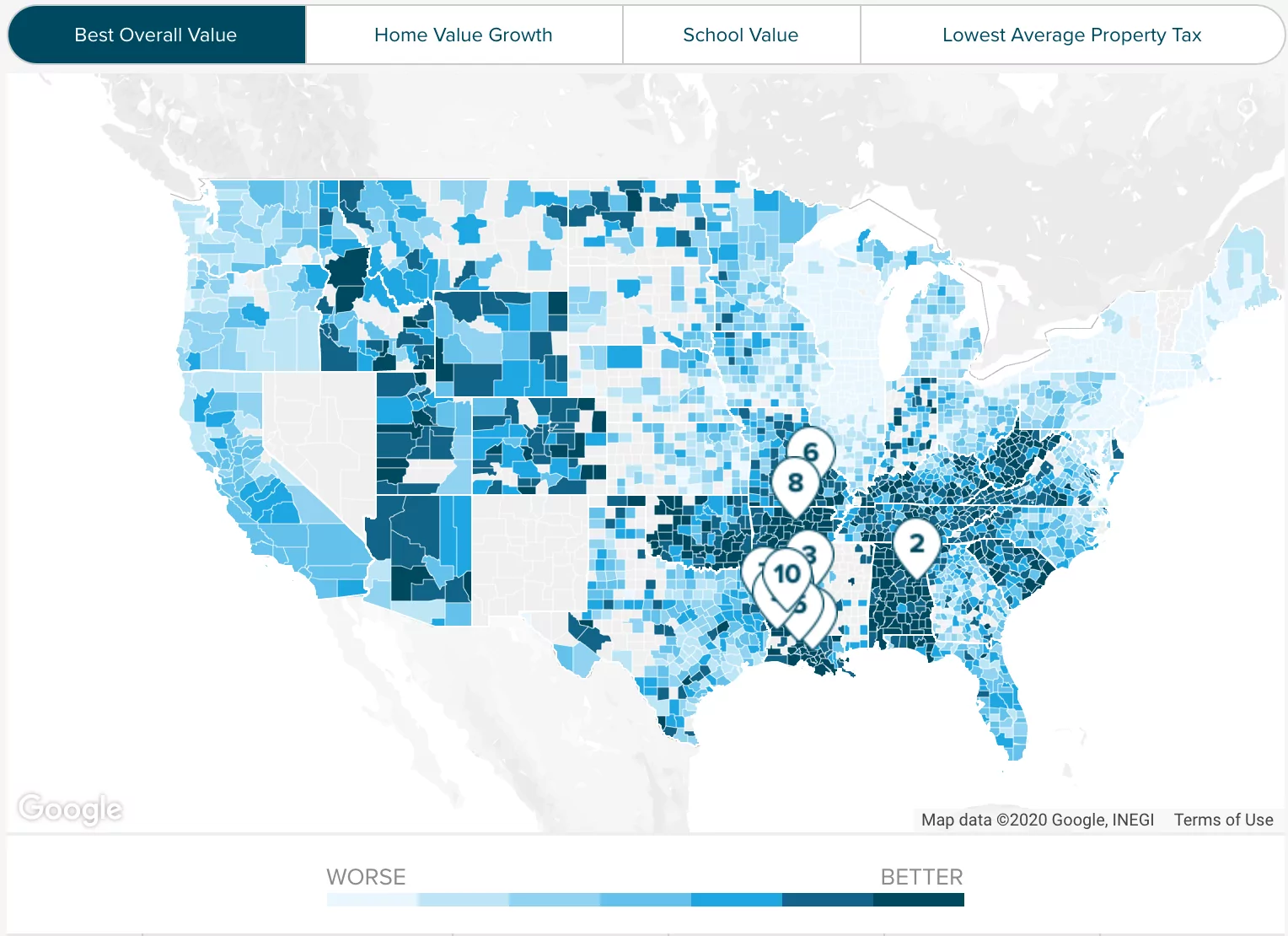

Ca Ftb Tax Payment Plans Or Installment Agreements

Solved Question 118 Web Pay Is An Online Application To Make Chegg Com

Can I Set Up A Payment Plan For Unpaid Payroll Taxes

What California Homeowners Should Know About Supplemental Tax Bills Quicken Loans

Irs Tax Payment Plans Installments Or Offer In Compromise

Irs Accepts Installment Agreement In San Francisco Ca 20 20 Tax Resolution

California State Tax H R Block

California Property Tax Calendar Escrow Of The West

Kern County Treasurer And Tax Collector

How Do Property Taxes Work In California

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

State Accepts Payment Plan In Lodi Ca 20 20 Tax Resolution

Pay Property Taxes Or Obtain Tax Bill Information Yolo County

Louisiana State Tax Payment Plan How To Apply For An Installment Agreement

California Covid 19 Stimulus Gap How To Get Your Money Los Angeles Times

I Owe California Ca State Taxes And Can T Pay What Do I Do

Irs Form 9465 Guide To Installment Agreement Request

California State Tax Software Preparation And E File On Freetaxusa